Are you ready to turn browsers into buyers? Maximize your e-commerce potential with professional E-Commerce account management.

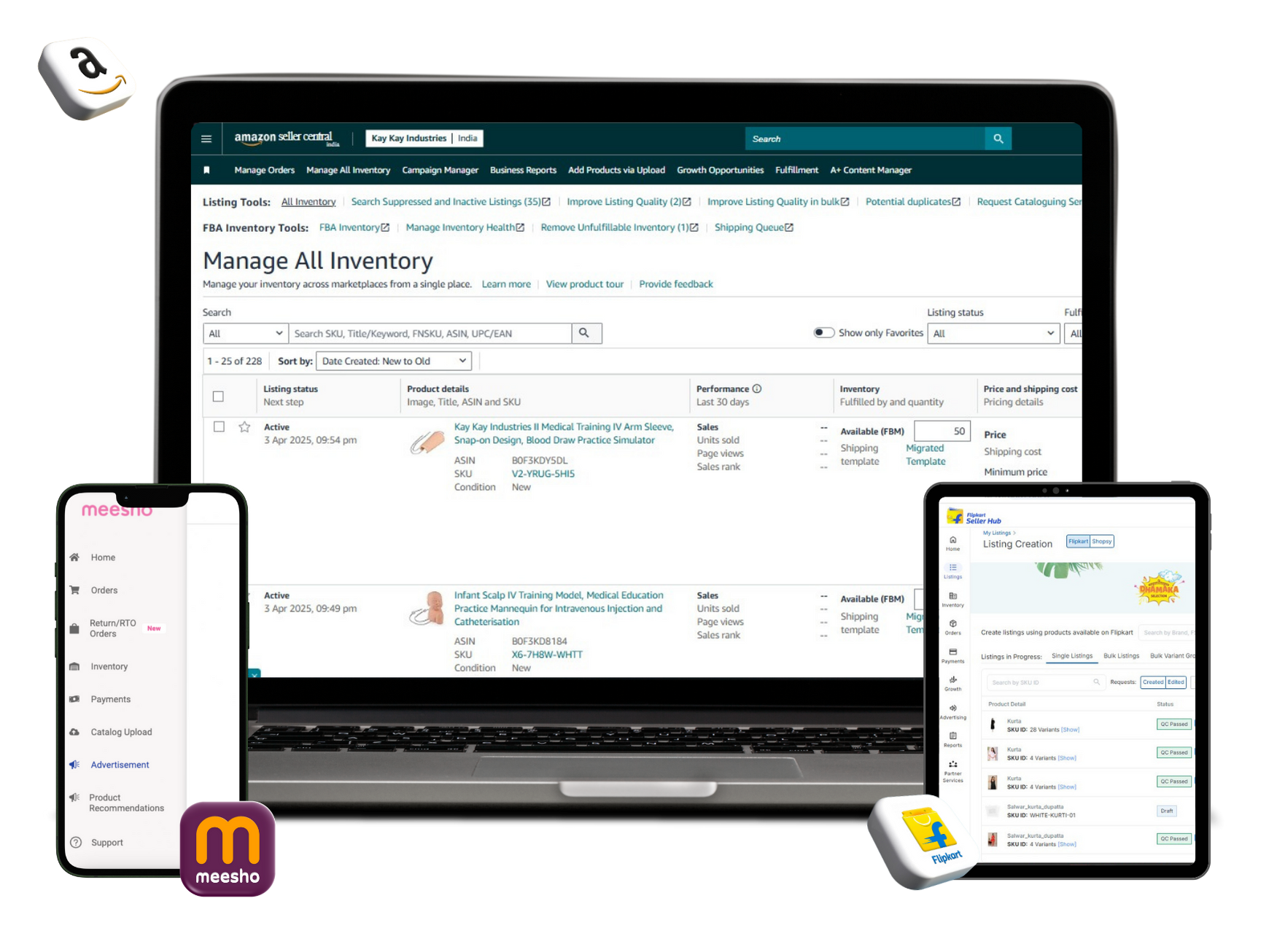

At Arvian, we manage your e-commerce account to boost your online sales. We will manage your account, so you can focus on what you do best to run your business. We will help you to stand out in this competitive online marketplace.

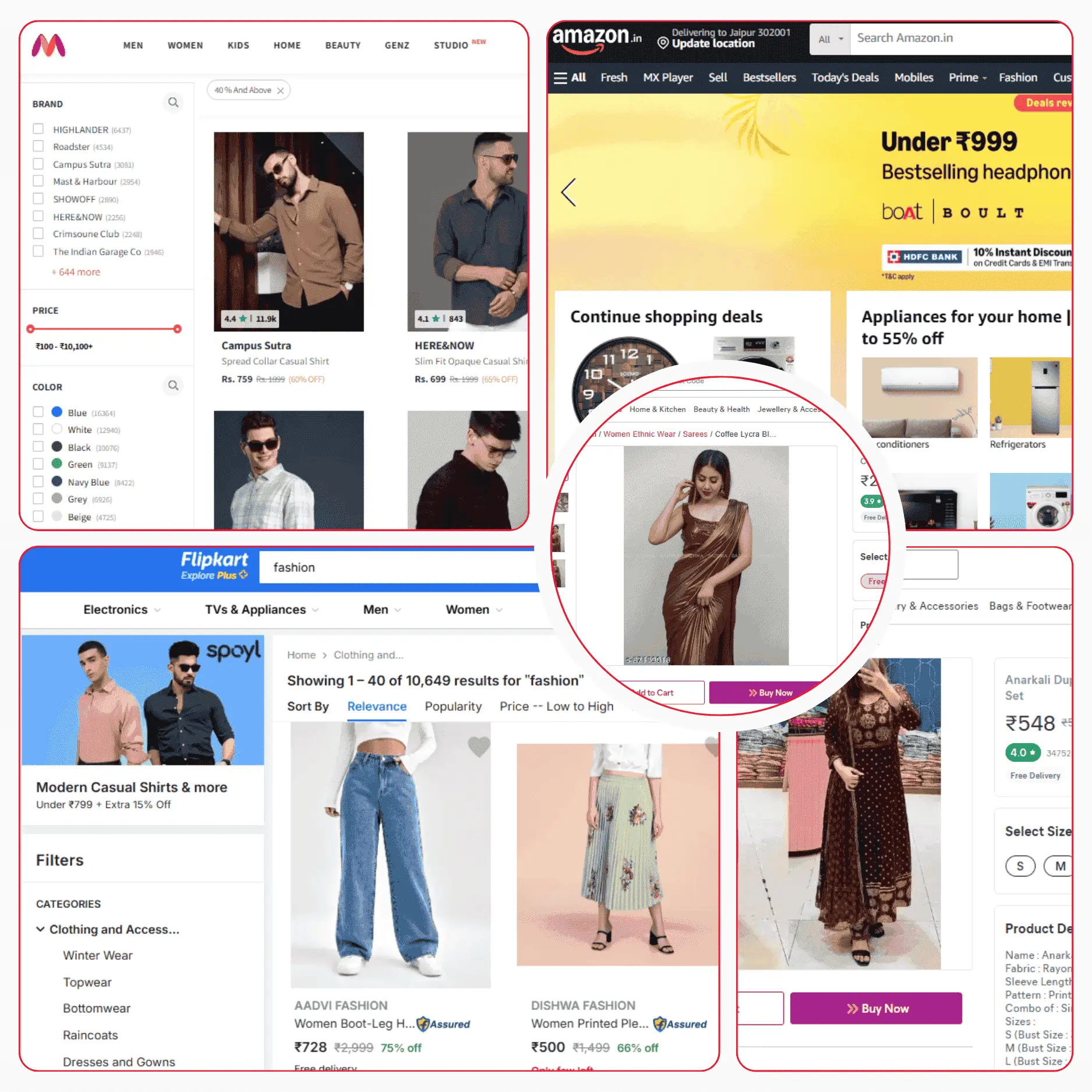

From product listing to performance marketing, we provide every support and help you to grow faster on various platforms like Amazon, Flipkart, Meesho, and more.

Let’s optimize your sales with our expert E-Commerce account management services.